CoinCola: Better alternative for sending money in and out of Nigeria

Money has been a part of human existence for centuries and has existed for 100,000 years. According to Wikipedia “money is any item or “verifiable record” that is generally accepted as payment for goods and services and repayment of debts.” Money is the medium of exchange whose value is based on several key factors such as interest rates, Economic Growth, Inflation and Current Account Balance.

Within the past 100,000 years, humans have used several forms of money ranging from trade by barter to banknotes. All these forms of money had its limitations and those limitations made bankers come up with alternatives that could replace any form of money that has huge limitations.

The current Evolution of money

- Trade by barter (Pre-Money Era): Barter is a form of money value system where different goods get exchanged based on perceived value by the owner of the goods or service. the barter system dates back to 6000 B.C and was officially first recorded in Egypt in 9000 B.C. Introduced and was introduced by Mesopotamia tribes for trading goods and services across cities.

- Coins: the use of coins introduced the next era of the use of money in the world. Coins were mostly in a metallic and form. This form of money was much easier to reason for the exchange of goods and services

- Bank Notes: This form of money gradually replaced coins in around the 13th 17th century and was used up till 2019 in many parts of the world, most especially in African countries. This phase also introduced digital money in the banking sector, bank customers could actually move their “banknotes” easily with the use of the internet. Although these banknotes don’t get moved electronically too, the banks made a programmable protocol that electronically debits or credits a customer’s account.

- Cryptocurrencies:

The next wave or form of money will of certainty be crypto-based, either on a public blockchain or private blockchain. Big tech companies like Facebook and even the Chinese government have already started making move towards creating a national cryptocurrency that could replace the current fiat.

The advantage of Crypto payments

The most popular way of making cross border payment was with the banks and over the years, banks have been working really hard to make sending and receiving money easy and cheap but the tech used by the banking system comes with a fee of about 5%-10% fee of the total sum being sent and the total sum doesn’t get delivered instantly.

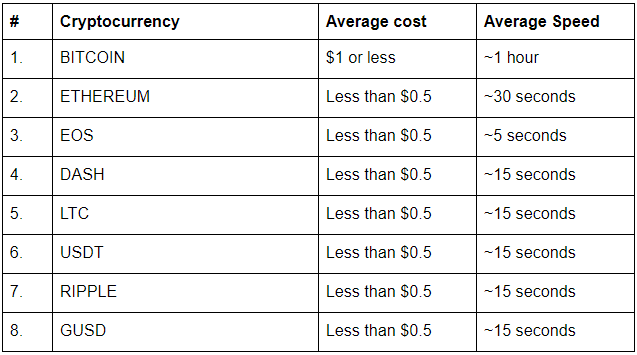

Cryptocurrency has been proven within the past 10 years to be a better, faster and cheaper alternative method for making cross border payment. According to this tweet, a certain group sent $400 million with a fee of just $1 worth of bitcoin and the got delivered within few hours. Another benefit of cryptocurrency is the fact that it can’t be censored by the banks or government. Making it a kind of money that could bring freedom to financial services. There are 9 different cryptocurrencies listed on coincola that can be used for making cross border payment with ease and with an extremely little fee.

Time and fee for the 9 cryptocurrencies on CoinCola

- How to make cross border payment with CoinCola AppThe following steps will guide you on how to use coincola to send and receive money easily with coincola app:

Download from IOS app store here or Android app here

- Register with email or phone number to create an account.

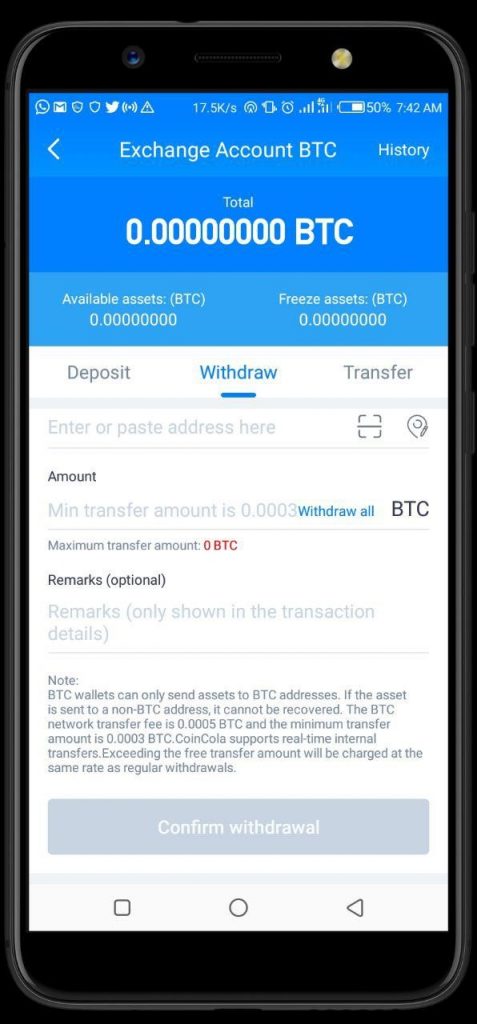

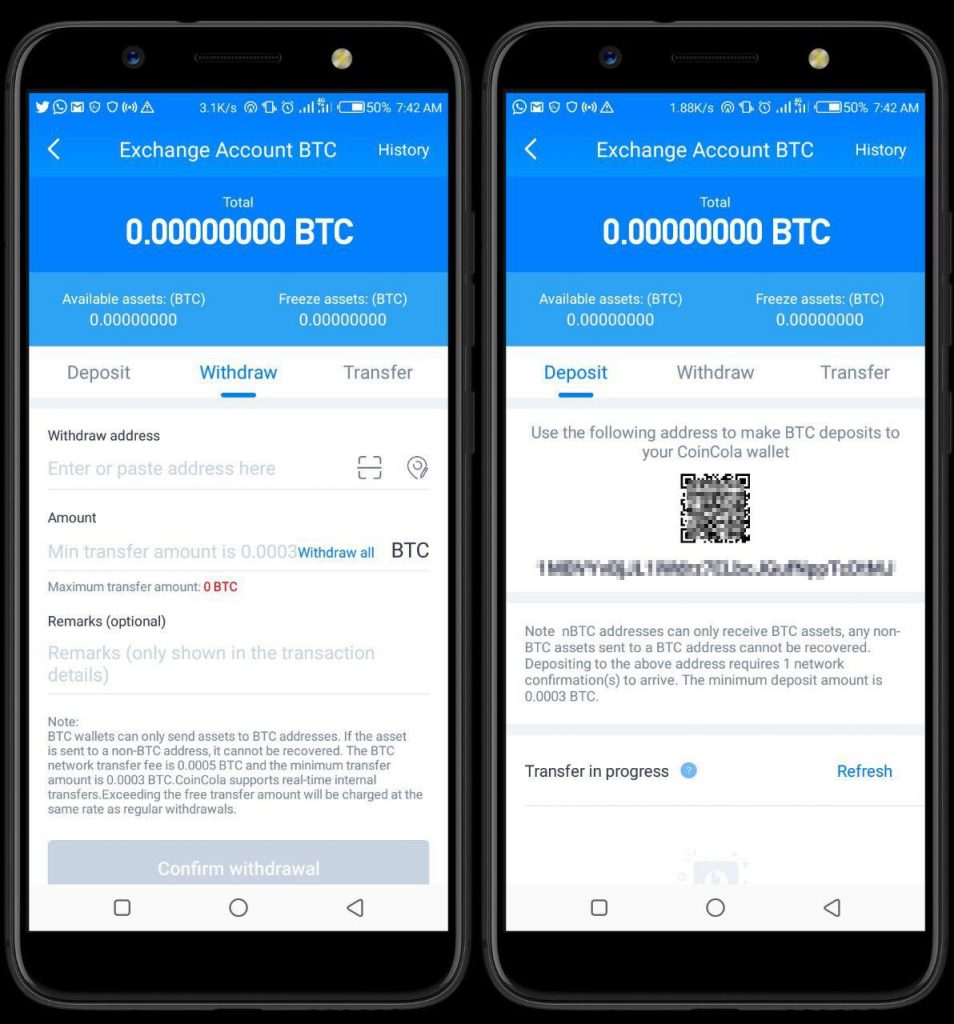

- Go to ”Wallet” and click withdraw or “Deposit”:

-

- Screenshot on the left is for withdrawals. All you need do is add the destination address to “Withdraw address” section and add the amount you wish to withdraw, remarks could include a short memo about the transaction, then Click “Confirm Withdrawal” when you have confirmed the Withdraw address and amount about to be sent are correct.

- Screenshot on the right is for deposit. All you need do is scan the deposit address to “Deposit” section or copy the deposit address.

As long as you follow the “notes” and instructions on the app, your funds will get to its destination within the specifies time in the table above.

Related Articles:

- How to Invest Bitcoin for Nigerians:https://www.coincola.com/blog/bitcoin-investment-guide-for-nigerians/

- How to Sell/Redeem Gift Cards for Naira: https://www.coincola.com/blog/redeem-gift-card-for-naira/