Understanding Libra Coin

In a Facebook post on 18 June, 2019 Mark Zuckerberg revealed what has the potential to become a ground-breaker in the world of cryptocurrencies – Libra Coin. A new cryptocurrency, backed by world-leading corporations, tasked with the mission to make financial services open to everyone.

That is Libra Coin on paper. In reality, a lot remains unclear about the new cryptocurrency, which makes it hard to make initial judgements about its future adoption and market potential. However, from all we know at this point, it seems like Libra Coin’s model is not the noble savior it is supposed to be. But much can change in the time until its official release in 2020 or later, so let’s take a look at the facts we know at this point.

What is Libra Coin?

In its official White Paper, Libra Coin is described as “a simple global currency and financial infrastructure that empowers billions of people”. Its mission is to “Reinvent money. Transform the global economy. So people everywhere can live better lives”. Libra Coin is designed as a stablecoin – a digital currency that has a relatively stable price because it’s supported by other types of currencies (usually government-backed) or securities. In the case of Libra, the cryptocurrency is backed by the Libra Reserve of real assets. The low-volatility cryptocurrency is intended to run on a new decentralized blockchain and a smart contract platform to create “responsible financial services innovation”. The members of the Libra Association hope for the newly-introduced coin to live up to its potential and deliver on the promise of becoming “the internet of money.”

Why is Facebook releasing the coin?

The main motivator is to try solve the problem of the unbanked population around the world. According to statistics, currently, 31% of the global population (or roughly 1.7b) don’t have access to banking services. The Libra Association makes a very accurate remark stating that the financial system now remains inaccessible to those who need it the most – people impacted by cost, reliability and usability.

That is why the introduction of Libra Coin and its whole concept make sense and have the potential to solve this problem. However, whether this happens or not, it all depends on the implementation of the idea.

The Libra Association points out some other reasons for the launch of the digital currency, such as to provide cheap capital for everyone, to bring back the right of the people to control the “fruit of their own legal labor” and to provide global, open, instant and low-cost movement of money to create immense economic opportunity.

The organization believes that the whole initiative will result into a majority of positives, such as the creation of 95 million new jobs, improvement of people’s earning by 20%, reducing extreme poverty by 22%, etc. All this sounds very promising, although, at this point, it remains unclear how the Libra Coin will manage to achieve all that.

But let’s now turn our focus on the reasons behind Facebook being at the helm of this initiative. The majority of Facebook’s profits come from advertising. Libra will be integrated into the company’s leading apps like Messenger and WhatsApp. This means that anyone can, at any point, send money or use it for advertising on the platform. The 1.7b unbanked market will have immediate access to funds, which paves the way for Facebook’s leading income channel to reach the rest of the 31% of the global population and its potential market to grow with 1.7b users. Apart from that, it also sets the foundations for Facebook to expand into payments and commerce in the future.

Another issue with the whole idea is that if Libra achieves even partial success, it would take over much of the monetary control from regulators and hand it over to the private companies, part of the Libra Association. However, to distance itself from the speculation about potential global manipulation, Facebook has limited itself to a single vote on the commission. This means that, in theory, the partners in the Association will vote democratically.

Yet, this does not limit the fear of the establishment of a powerful new corporate layer of monetary control between central banks and individuals, which is in total dissonance with the core idea of cryptocurrencies – to decentralize the financial system by turning it into a p2p network and removing third-party intermediaries.

Who is a part of this?

The Libra Coin is established and governed by the Libra Association, described in the white paper as “an independent, not-for-profit membership organization, headquartered in Geneva, Switzerland”. Choosing Switzerland is a wise decision as it is a country known for its global financial neutrality and out-of-reach for the EU financial regulations.

The Association consists of 28 companies, non-profits and multilateral organizations. Some of the members include Visa, Mastercard, Paypal, eBay, Facebook, Uber, Lyft, Spotify, Vodafone, Coinbase, Andreessen Horowitz, Women’s World Banking, etc. (a full list is available here). The Association is expected to continue to grow and reach approximately 100 members at the start of next year.

The Libra Association has two main goals. The first one is technical – to look after the development and technical roadmap of the project, while the second one is financial – to manage the reserve and allocate funds to social-impact causes. When voting on particular organizational and technical matters, all decisions require the consent of two-thirds of the members’ votes.

When and where can you buy Libra coin?

The project is expected to launch officially in the first half of 2020. Whether the team behind Libra will manage to keep up with the timeframe, it remains to be seen. All the work and unanswered questions that should be addressed in the meantime, alongside potential on-the-go developments and regulatory issues may significantly delay the deadline.

The philosophy of Libra supposes for it to be accessible by each and every individual, no matter his geographical location. The idea is users to be able to exchange the coin for fiat money in every national currency around the world. Thanks to the payment-processing partners in the project, Libra will be accessible to anyone with a smartphone and data connectivity. According to Zuckerberg, the process will be just as easy as using apps for message and photo sharing.

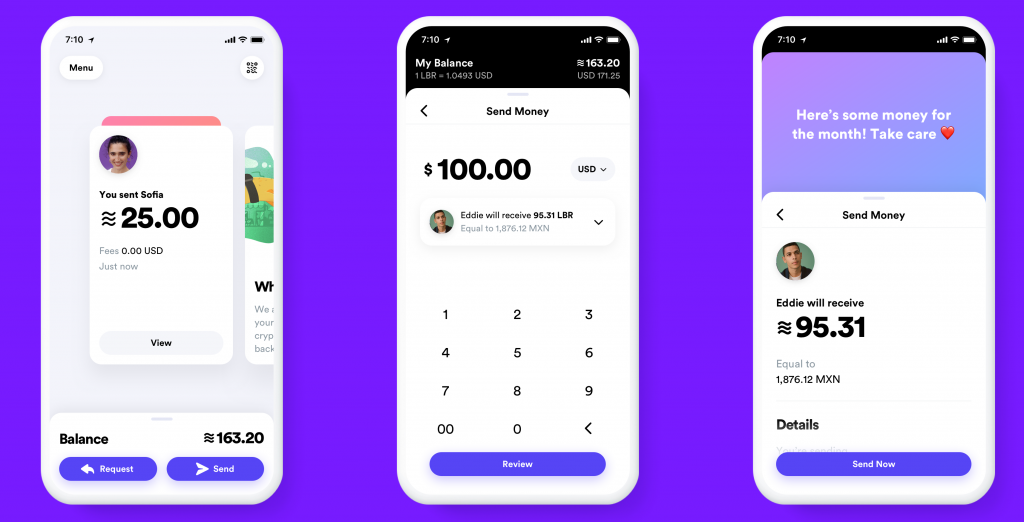

For the storage of the Libra coins, Facebook launches a stand-alone app, as well as a built-in feature in Messenger and WhatsApp, named “Calibra”. It will be responsible for the spending, saving and storage part of the process. Calibra is going to be regulated just like other payment service providers. At first, Calibra will be limited to sending and receiving Libra to your contacts. According to its roadmap, however, in the near future, it will become a payment app that will allow you to buy coffee, pay bills, etc.

What comes next and what issues will Libra have to deal with

The truth is that many questions remain unanswered and it seems the Libra project was announced too early. The Libra Association may have looked at the whole initiative as a good way to combine the positives of both – the cryptocurrency (stablecoins in particular) and the fiat worlds, but the plan for achieving this, however, seems far from being entirely clear.

- Libra can become a threat to unstable economies

If Libra becomes highly successful and people from emerging markets and less-developed countries start using it as a preferred payment method, it will result in a disruption of the local economy. People will easily move from unstable currencies into one denominated in euros or dollars. This may result in significant economic issues for the countries and raise the local tension.

A basic economic principle is that the fewer fiat money is held in the local economy, the more unstable it is. If more users shift to Libra instead of rupees, for example in the case of India, the lesser control the local national bank will have on its economy. This will prevent it from being efficient in times of economic distress and its ability to stimulate the economy.

- It can’t escape regulation

The idea of launching Libra as a cryptocurrency, but with the same nature as a traditional currency was a wise way to avoid regulation. However, if Libra becomes highly successful, the oversight authorities will surely make an exemption and try to intervene. In fact, some regulators and global organizations like the G7 and the IMF have already issued statements or formed working groups to look into the matter.

Even if Zuckerberg and co. hoped for manoeuvering around the regulatory compliance policies due to Libra’s idea of decentralization, this case will turn out to be an exception from all rules. Oversight authorities have already stated that Libra may pose systemic risks for the global financial system. Mike Carney, the head of the Bank of England, said that if such a currency becomes popular, it will surely be systemic and will have to become a subject to the highest form of regulation.

- “Decentralized” but is it?

Libra aims to be a decentralized cryptocurrency, just like Bitcoin or Ethereum. This indicates that no oversight authority will be able to control it. The thing is there is no one behind Bitcoin and Ethereum, while there is a bunch of the world’s most powerful corporations behind Libra. This basically means that the control over the digital currency will be shifted from financial regulators to global corporations – something that may lead to more negatives, rather than positives.

Aside from that, the Association will be able to choose independently with what companies to work with, which will result in a pure form of market monopoly instead of an independent decentralized structure.

David Marcus, the head of the Libra project, addressed this issue by saying that the network will eventually become distributed, but he wasn’t sure when will that happen.

- Some big corporations may be against it

Technological giants in the face of Google, Facebook’s main rival in terms of online advertising, as well as leading financial institutions may not be too fond of a new dominant cryptocurrency. In the past, investment banks have been vocal that they cannot engage in cryptocurrency transactions due to the risk of trafficking and money laundering. Apart from that, they are subject to a hefty regulation from a variety of oversight authorities, which will also conflict such an idea.

Google and other technology giants, may consider the project as a sure way for Facebook to come on top and become an all-in-one digital solution – a powerful communication channel, an advertising platform and a payment tool.

- The price formation concept raises some doubts

The idea of a stablecoin is to mimic the price of a certain currency – the USD in the case of Tether, for example. The Libra project, however, is intended to release two different coins – Libra and the Libra Investment Token. While Libra is designed to be backed by low-risk assets with the price being a ratio between the value of the fund and the circulating supply (much like the case with currencies and assets), the Libra Investment Token adds a different dimension to the whole concept.

The money raised from the sale of the token is intended to be invested in more low-risk assets. The revenue from these investments will fund the Libra Association activities. This means that there is also an investment part of the whole concept which raises some doubts about the way the whole idea will be implemented.

The fact that Libra is intended to be linked to other currencies indicates that it is susceptible to inflation, which in no way makes it a better way of transacting value in terms of economic principles, than the USD or the EUR.

In a Nutshell

The truth is that the Libra project has amazing potential. However, all this potential is covered in controversy. It is hard to imagine how its execution will pan out and materialize the concept of a centralized stable coin that will at some point become decentralized with the structure, proposed in its White Paper. Whether Libra will become the first digital currency to become a subject of regulation and in harmony with the existing world financial system, remains to be seen. For now, though, there are more questions rather than answers.