Weekly Updates Vol.4 (2018.12.1-2018.12.7)

Weekly Market Review

A/ Market Status quo

As of 17:00 GMT on Friday (December 7th),the total market cap of cryptocurrencies reaches 170.001 billion dollars, and transaction volume of cryptocurrencies reaches 17.758 billion dollars. Compared with the end of Nov(with a total market cap of $130.541billion and 24h trading volume of $16.843 billion) the total market cap down about 18% and transaction volume rose about 5.4%.

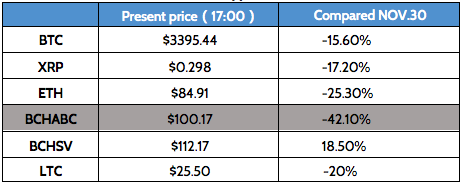

The price of mainstream cryptocurrencies is fluctuant, which is shown in the following table.

B/ Market Analysis

Only nine cryptocurrencies secure a market cap over $1 billion

According to Coinmarketcap, with the cryptocurrency market slump, there are only nine cryptocurrencies have a market value of more than $1 billion. In addition, bitcoin has the highest market value of $59 billion.

Weekly Industry News

A/ President Maduro Orders a Triple Increase of Oil Price In Venezuela

According to Bitcoin, Venezuela’s President Nicolas Maduro has announced that the price of the petrol, his country’s national “cryptocurrency,” has been increased from 3,600 sovereign bolivars to 9,000.

B/ Bitcoin Trading Volume Exceeds $2 Trillion in 2018

According to Bitcoinist, the total Bitcoin trading volume for the year has already crossed $2 trillion. The figures posted so far represent a 61 percent increase from last years total volume of $870 billion. Earlier in the year, Bitcoinist reported that digital currency trading might grow by 50 percent in 2019 based on a study by Satis Group.

C/ Nasdaq Will Launch BTC Futures in First Half of 2019

According to ambcrypto, Earlier this week, rumors emerged that Nasdaq, a securities exchange considered only second to the New York Stock Exchange [NYSE] will launch futures contracts for Bitcoin [BTC]. This has now been confirmed by the Vice President of Nasdaq’s media team, who has stated that the contracts will be listed and launched in the first half of next year.

Policy Tracking

A/ G20 Summit: We will Regulate Cryptocurrencies

According to Bitcoinist, G20 countries have agreed to regulate cryptocurrencies in line with Financial Action Task Force (FATF) standards at the second session of the summit held in Buenos Aires, Argentina. In addition, it point out that a consensus-based solution update in 2019 and a final report in 2020.

B/ SECAgain Delays Decision on VanEck-SolidX Bitcoin ETF

According to Coindesk, The U.S.Securities and Exchange Commission (SEC) extended a rule change proposal allowing the nation’s first bitcoin exchange-traded fund (ETF), pushing the decision deadline to next year.

The securities regulator said it was extending the review period for the ETF to Feb. 27, 2019. The proposal was first submitted by money manager Van Eck and blockchain startup SolidX.

Promotions

A/ As of 9:00 AM on Friday, CoinCola is launching support for the XRP. From now on to 31st Dec, Users can get 50% off of the transaction fee, and extra bonus for trading.

B/ CoinCola is starting the official countdown to Christmas with daily BTC giveaway and a week of LIVE contest to win the grand prize! It’s our 13 days of MEGA giveaway – everybody wins!

![[:en]coincola weekly update 4[:]](https://www.coincola.com/blog/wp-content/uploads/2018/12/Group-4.jpg)