Trading Secrets: Dollar to Cedis Black Market’s Ripple Effects Uncovered

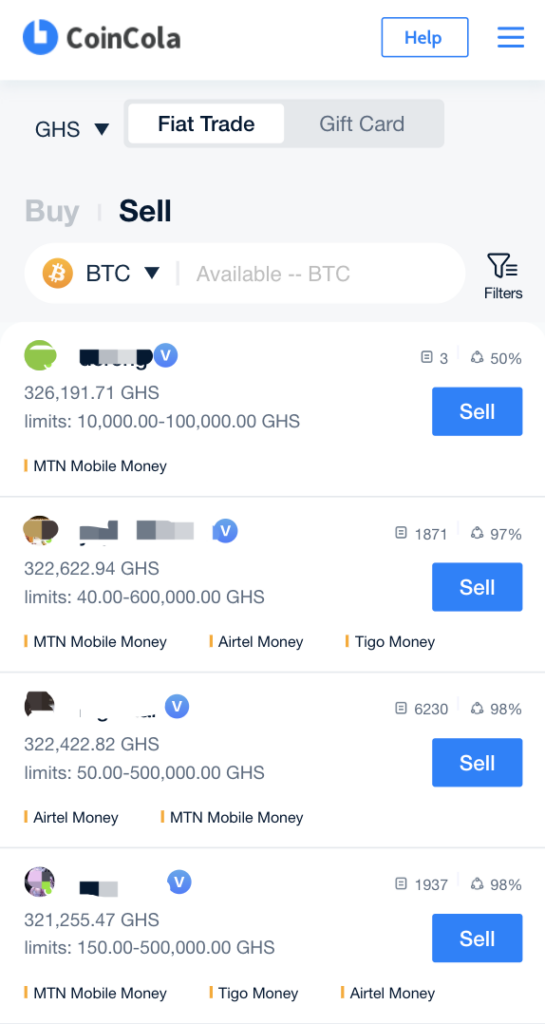

The Dollar to Cedis black market exchange rate refers to the unofficial rate at which the US Dollar is traded for Ghanaian Cedis outside of formal financial systems. While official exchange rates are determined by governments and central banks, black market rates emerge from a network of unofficial dealers and parallel markets.

Introduction

In a rapidly globalizing world, where economic transactions transcend borders, exchange rates play a pivotal role in shaping international trade, investment, and travel. This article delves into the intricate world of exchange rates, shedding light on the intriguing black market phenomenon that often shadows these rates. We’ll explore the factors that sway the Dollar to Cedis exchange rates, its impact on various sectors, and the perspectives of businesses, travelers, and investors. Additionally, we’ll examine government regulations, pros and cons of black market rates, and strategies to tackle currency volatility. By the end, you’ll have a comprehensive understanding of the exchange rate landscape and its potential future trajectory.

Understanding Exchange Rates

Exchange rates are the bedrock of international financial interactions, determining the value of one currency in relation to another. These rates fluctuate due to a myriad of factors, from economic indicators to geopolitical events. Exchange rates influence the competitiveness of exports and imports, the profitability of investments, and the affordability of travel.

The Black Market Phenomenon

Amidst the regulated currency exchange systems exists an intriguing and often controversial phenomenon: the black market. This clandestine realm operates outside official channels, offering an alternative platform for currency trading. The black market can thrive in economies with restrictive exchange controls, political instability, or economic uncertainty.

You may like The Hidden Economy: Exploring the Black Market Rate of Dollar to Naira

Factors Influencing Dollar to Cedis Rates

Several forces converge to mold the Dollar to Cedis exchange rates, with economic indicators, political stability, and market speculation taking center stage.

- Economic Indicators: The health of a nation’s economy significantly impacts its exchange rates. Factors like GDP growth, inflation rates, trade balances, and employment figures collectively influence investor sentiment and currency values.

- Political Stability: Political stability fosters investor confidence and encourages foreign investment, often resulting in a stronger currency. Conversely, political turmoil or uncertainty can trigger currency depreciation.

- Market Speculation: Traders and investors in the foreign exchange market can drive short-term fluctuations through speculative activities. Market sentiment, news, and global events can trigger swift changes in exchange rates.

Impact on Businesses and Trade

The Dollar to Cedis exchange rate plays a crucial role in international trade, impacting the cost of imports and exports. Fluctuations can influence profit margins and competitiveness.

- Export-Import Costs: A higher Dollar to Cedis black market rate may increase the cost of importing goods, affecting a business’s bottom line.

- Export Competitiveness: A favorable exchange rate can enhance a country’s export competitiveness by making its goods more affordable for foreign buyers.

- Supply Chain Disruptions: Rapid currency fluctuations can disrupt supply chains, leading to uncertainty in production and delivery schedules.

Implications for Travelers and Tourism

For travelers, exchange rates affect the purchasing power of their currency abroad. A stronger Dollar can make travel to Ghana more affordable.

- Travel Costs: A higher Dollar to Cedis exchange rate can result in lower travel expenses for tourists visiting Ghana from Dollar-denominated countries.

- Tourism Boom: Favorable exchange rates may attract more tourists, boosting the local tourism industry and the economy.

- Local Spending: Tourists with stronger currency may have increased spending capacity, benefiting local businesses.

Investors’ Perspective

Investors trading between the Dollar and Cedis navigate currency risks. Exchange rate fluctuations can impact investment returns.

- Currency Hedging: Investors may use financial instruments like currency futures or options to hedge against currency risk.

- Portfolio Diversification: Diversifying investments across different currencies can help mitigate the impact of exchange rate fluctuations.

- Risk-Return Tradeoff: Exchange rate fluctuations can introduce both opportunities and risks, affecting the overall risk-return profile of investment portfolios.

Government Measures and Regulations

Governments often intervene to stabilize exchange rates through measures such as interest rate adjustments, foreign exchange market interventions, and capital controls. These efforts aim to maintain economic stability but can also inadvertently fuel black market activities.

Pros and Cons of Black Market Exchange Rates

The black market provides an avenue for individuals and businesses to access currency when official channels are constrained. However, it can also facilitate illegal activities and contribute to inflation. Black market rates can differ significantly from official rates, leading to disparities in purchasing power.

- Pros – Accessibility: The black market can provide access to foreign currency when official channels are limited.

- Pros – Liquidity: In times of crisis, the black market can offer liquidity when formal systems may be strained.

- Cons – Fraud: Black market transactions are less regulated, making them susceptible to fraudulent activities.

Addressing Currency Volatility

Businesses, investors, and governments employ various strategies to mitigate the impact of currency volatility. These include hedging, diversification, and implementing robust fiscal and monetary policies.

Future Outlook

The exchange rate landscape is influenced by a dynamic interplay of economic, political, and social factors. As economies continue to evolve, technological advancements and policy changes will shape the future trajectory of exchange rates.

Conclusion

In the intricate dance of global finance, exchange rates emerge as a critical determinant of economic stability and prosperity. Understanding the nuanced factors that influence Dollar to Cedis rates and the intriguing dynamics of the black market provides valuable insights for businesses, travelers, investors, and policymakers alike. As we navigate an ever-changing world, the grasp of exchange rates’ significance empowers us to make informed decisions in an interconnected global economy.

FAQs

Participating in black market exchanges may be illegal in some jurisdictions, as it often circumvents official regulations.

The black market rate is determined by unofficial channels and may deviate significantly from the official rate due to supply, demand, and other factors.

Black market rates exist due to various reasons, including limited access to official channels, speculation, and currency controls.

Yes, fluctuations in exchange rates can affect the cost of imports, exports, and profit margins for international businesses.

Individuals and businesses can consider strategies like hedging or diversifying their currency exposure to manage currency volatility effectively.