The Ultimate Bitcoin Calculator: A Comprehensive Guide to Analyzing and Optimizing Your Investments

Introduction

In today’s digital currency market, Bitcoin has emerged as a revolutionary asset with immense potential. As an investor, it’s essential to understand the significance of Bitcoin and the role it plays in shaping the financial landscape. Making informed investment decisions is crucial, and one tool that can greatly assist in this process is a Bitcoin calculator. In this article, we will explore the concept of Bitcoin, and its advantages as an investment, and delve into the world of Bitcoin calculators, highlighting their benefits and providing guidance on how to use them effectively.

I. Understanding Bitcoin and Its Potential

What is Bitcoin?

Bitcoin, the first decentralized digital currency, was introduced in 2009 by an anonymous person or group of individuals known as Satoshi Nakamoto. It operates on a peer-to-peer network called the blockchain, which ensures transparency, security, and immutability. Bitcoin offers a decentralized alternative to traditional centralized financial systems, allowing for faster and more affordable transactions across borders.

The Advantages of Bitcoin Investments

Investing in Bitcoin presents several advantages. First and foremost, Bitcoin offers the potential for substantial returns on investment. Over the years, Bitcoin has witnessed remarkable growth, outperforming many traditional assets. Additionally, Bitcoin’s limited supply and increasing demand contribute to its potential as a store of value. Furthermore, Bitcoin investments offer a hedge against inflation and provide an opportunity for portfolio diversification.

Current Market Trends and Opportunities

The world of Bitcoin is constantly evolving, and staying updated on current market trends and opportunities is crucial for investors. Here are some key insights into the latest developments in the Bitcoin market:

- Increasing Institutional Adoption: Bitcoin has gained significant attention from institutional investors, with renowned companies and financial institutions incorporating Bitcoin into their investment portfolios. This institutional adoption not only brings credibility to the market but also increases liquidity and stability.

- Regulatory Developments: Governments around the world are actively exploring regulations for cryptocurrencies, including Bitcoin. This regulatory focus aims to provide a clear legal framework for investors and foster the growth of the cryptocurrency market. Stay informed about regulatory updates to make well-informed investment decisions.

- Rising Interest from Retail Investors: Bitcoin has captured the interest of retail investors globally. The accessibility of cryptocurrency exchanges and the potential for substantial returns have attracted a growing number of individuals to participate in Bitcoin investments. The increasing retail investor base contributes to the overall market growth and liquidity.

- Technological Advancements: The Bitcoin ecosystem continues to evolve, with ongoing technological advancements. Developments such as the Lightning Network, which aims to enhance scalability and transaction speed, and improvements in wallet security and user experience are paving the way for wider adoption and usage of Bitcoin.

- Market Volatility and Opportunities: Bitcoin’s inherent volatility presents both risks and opportunities. While market fluctuations can be daunting, they also provide opportunities for traders to profit from short-term price movements. Understanding market trends, utilizing technical analysis, and setting appropriate risk management strategies are key to navigating this volatile market.

- DeFi and Bitcoin: The emergence of decentralized finance (DeFi) has created new possibilities for utilizing Bitcoin within the decentralized ecosystem. Bitcoin-backed lending, yield farming, and decentralized exchanges are some of the avenues where Bitcoin holders can explore additional opportunities and generate returns.

- Global Economic Uncertainty: Bitcoin’s decentralized nature and limited supply make it an attractive asset during times of economic uncertainty. Factors such as inflation, geopolitical tensions, and monetary policy decisions can impact traditional financial markets and drive investors towards alternative assets like Bitcoin.

Keeping a close eye on these market trends and opportunities empowers investors to make informed decisions and capitalize on potential growth in the Bitcoin market. Remember to conduct thorough research, assess risk factors, and consider your investment goals before taking any investment actions.

II. The Role of a Bitcoin Calculator

Importance of Calculating Bitcoin Investments

Precise calculations are vital when it comes to investing in Bitcoin. A Bitcoin calculator plays a pivotal role in accurately assessing the potential profitability of Bitcoin investments. It enables investors to estimate returns, analyze risks, and make informed decisions based on their investment goals.

Benefits of Using a Bitcoin Calculator

Using a Bitcoin calculator offers several benefits. It provides investors with valuable insights into potential returns based on different investment scenarios. Investors can experiment with various factors such as investment amount, time horizon, and expected growth to evaluate different strategies. Furthermore, a Bitcoin calculator helps users estimate transaction fees and expenses, allowing for a more accurate assessment of potential profits.

Popular Bitcoin Calculator Tools

A range of Bitcoin calculator tools is available to assist investors in their decision-making process. Some notable options include CoinCola‘s Bitcoin Calculator, CoinMarketCap’s Bitcoin Calculator, CryptoCompare’s Bitcoin Mining Calculator, and TradingView’s Bitcoin Profit Calculator. These tools offer a user-friendly interface and provide customizable features to suit individual preferences.

III. Key Metrics for Bitcoin Calculations

Bitcoin Price and Market Cap Analysis

Analyzing Bitcoin’s price and market capitalization is essential for understanding its value and growth potential. Bitcoin’s price reflects market sentiment and demand-supply dynamics, while market capitalization indicates its overall value in the market. Monitoring these metrics allows investors to gauge the relative position of Bitcoin and make informed decisions.

Historical Performance Evaluation

Assessing Bitcoin’s historical performance is crucial for understanding its volatility and potential for returns. Historical data reveal patterns, trends, and market cycles that can guide investment strategies. Analyzing past performance helps investors set realistic expectations and evaluate the risk associated with Bitcoin investments.

Assessing Volatility and Risk Factors

Bitcoin’s volatility is a key consideration for investors. Understanding the risk factors associated with Bitcoin investments helps in formulating risk management strategies. Calculating metrics such as standard deviation, beta, and Value at Risk (VaR) allows investors to assess the potential downside and take appropriate measures to mitigate risks.

IV. Using a Bitcoin Calculator for Profitability Analysis

Calculating Potential Returns on Bitcoin Investments

A Bitcoin calculator enables investors to estimate potential returns based on different investment scenarios. By inputting variables such as investment amount, time horizon, and expected growth, investors can evaluate the profitability of their Bitcoin investments. The calculator provides a clear picture of the potential gains and helps in setting realistic investment goals.

Factoring in Transaction Fees and Expenses

Accurate calculation of transaction fees and expenses is essential for determining the actual returns from Bitcoin investments. A Bitcoin calculator takes into account transaction fees associated with buying, selling, and transferring Bitcoin. By factoring in these costs, investors can better understand the net profitability of their investments.

Analyzing Different Investment Strategies

A Bitcoin calculator allows investors to experiment with various investment strategies and analyze their potential outcomes. By adjusting variables such as investment amount, holding period, and expected growth, investors can compare different scenarios and make informed decisions. This analysis helps in identifying the most optimal strategy for maximizing returns while managing risks.

You may like How to Buy Bitcoin with Fiat Money?

V. Optimizing Bitcoin Investments

Diversification and Risk Management

Diversification is a fundamental principle in investment. Bitcoin calculators assist investors in optimizing their portfolios by considering Bitcoin’s role in a diversified investment strategy. By allocating a portion of their portfolio to Bitcoin based on calculated risk and potential returns, investors can benefit from the growth potential of Bitcoin while managing overall portfolio risk.

Dollar-Cost Averaging Strategy

Dollar-cost averaging (DCA) is a strategy that involves investing a fixed amount of money in Bitcoin at regular intervals, regardless of its price. Bitcoin calculators facilitate the implementation of DCA by providing insights into the potential returns of such a strategy over time. This approach helps investors mitigate the impact of short-term price volatility and benefit from long-term growth.

Leveraging Bitcoin Calculator for Smart Decision Making

A Bitcoin calculator acts as a valuable tool for making smart investment decisions. By analyzing potential returns, factoring in fees and expenses, and considering different investment strategies, investors can optimize their decision-making process. Bitcoin calculators provide a data-driven approach to investing, empowering investors to make informed choices based on their financial goals.

Case Studies of Successful Bitcoin Investments

Case Study 1: Early Adoption Pays Off

John, an early Bitcoin adopter, purchased 100 Bitcoins in 2011 when the price was just $1 per Bitcoin. He held onto his investment, believing in the long-term potential of the cryptocurrency. In 2017, during the Bitcoin bull run, the price soared to $20,000 per Bitcoin. John decided to sell a portion of his holdings, making a profit of $1,999,000. His initial investment of $100 turned into a substantial return, showcasing the incredible growth and profitability of Bitcoin for early adopters.

Case Study 2: Strategic Trading and Timing

Sarah, an experienced trader, closely monitored Bitcoin’s price movements and identified a pattern of market cycles. She strategically bought Bitcoin at the end of a bear market when prices were low. She patiently held onto her investment and sold when Bitcoin reached a new all-time high during the bull market. By timing her trades and capitalizing on market trends, Sarah was able to generate significant profits and grow her initial investment by over 300%.

Case Study 3: Diversification and Long-Term Hold

David, a conservative investor, decided to allocate a portion of his investment portfolio to Bitcoin for diversification purposes. He purchased Bitcoin regularly over a period of several years, using the dollar-cost averaging strategy. Despite experiencing short-term market fluctuations, David remained steadfast in his long-term investment approach. After holding his Bitcoin for five years, he witnessed a substantial increase in value as Bitcoin reached new heights. David’s patience and commitment to a diversified, long-term hold resulted in significant returns on his investment.

Case Study 4: Seizing an Opportunity

Lisa, an entrepreneur, recognized the growing popularity of cryptocurrencies and decided to start accepting Bitcoin as payment for her online business. Over time, as Bitcoin’s price appreciated, the Bitcoin she accumulated through customer payments gained significant value. By embracing the use of Bitcoin and leveraging its increasing adoption, Lisa not only received payments in a global currency but also witnessed her Bitcoin holdings appreciate in value, offering an additional avenue of profit generation.

These real-life case studies highlight different strategies and approaches to successful Bitcoin investments. Whether through early adoption, strategic trading, long-term hold, or utilizing Bitcoin in business operations, individuals have achieved substantial profits and financial growth. It’s important to note that these case studies reflect specific situations and outcomes and may not be indicative of future results. Conducting thorough research, understanding risk factors, and making informed investment decisions based on individual circumstances are crucial in the dynamic world of Bitcoin investments.

You may like Invest Smarter, Not Harder: How AI-Powered Crypto Trading Can Help

Discuss Tax Implications and Regulations Related to Bitcoin Investments

As Bitcoin and other cryptocurrencies continue to gain popularity, governments around the world have recognized the need for regulatory frameworks to govern their use and taxation. Understanding the tax implications and regulations related to Bitcoin investments is crucial for investors to remain compliant and avoid any potential legal issues. Here are key points to consider:

- Classification and Taxation: The classification of Bitcoin for tax purposes varies by jurisdiction. In some countries, Bitcoin is treated as property or an asset, subject to capital gains tax. Other jurisdictions may consider it as a currency, making it subject to regular income tax. It is important to consult with a tax professional or research the specific regulations in your country to determine the appropriate tax treatment.

- Capital Gains Tax: Many countries impose capital gains tax on the profit earned from the sale or exchange of Bitcoin. The capital gains tax rate may vary based on factors such as holding period, income level, and specific tax laws in each jurisdiction. It is essential to keep accurate records of Bitcoin transactions, including purchase dates, sale prices, and associated fees, to calculate capital gains or losses accurately.

- Reporting Obligations: Tax authorities in various countries require individuals to report their Bitcoin holdings and transactions. This may include reporting the value of Bitcoin holdings at the end of the tax year, as well as disclosing any gains or losses from the sale or exchange of Bitcoin. Failure to report Bitcoin transactions can result in penalties or legal consequences, so it is important to stay informed about reporting obligations and comply with them accordingly.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations: Some countries have implemented AML and KYC regulations for cryptocurrency exchanges and businesses operating in the crypto space. These regulations aim to prevent illicit activities such as money laundering and terrorist financing. Investors should be aware of the requirements imposed by exchanges or platforms they use to buy or sell Bitcoin and ensure compliance with AML and KYC procedures.

- International Tax Considerations: Bitcoin investments may involve cross-border transactions, which can introduce additional complexities in terms of taxation. Different countries may have different tax rules and treaties that govern the taxation of international transactions. It is advisable to seek professional advice when dealing with international Bitcoin investments to navigate the potential tax implications effectively.

- Reporting Losses: In case of losses incurred from Bitcoin investments, it may be possible to offset those losses against other capital gains or income, depending on the tax laws in your jurisdiction. Keeping detailed records of losses and consulting with a tax professional can help determine the eligibility for claiming such losses.

- Evolving Regulations: It is important to note that regulations surrounding Bitcoin and cryptocurrencies are still evolving. Governments and regulatory bodies continue to assess and update their policies to keep up with the fast-paced crypto industry. Staying informed about any regulatory changes or updates is crucial to ensure compliance and mitigate any potential risks.

Given the complex nature of tax implications and regulations related to Bitcoin investments, it is highly recommended to consult with a qualified tax professional who specializes in cryptocurrency taxation. They can provide personalized advice based on your specific circumstances and help you navigate the ever-changing landscape of tax laws and regulations associated with Bitcoin investments.

VI. Choosing the Right Bitcoin Calculator Tool

Features to Look for in a Bitcoin Calculator

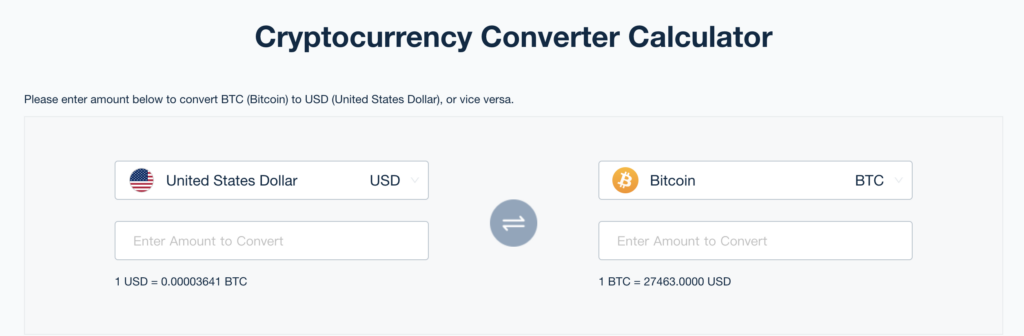

When selecting a Bitcoin calculator tool, it’s essential to consider certain features. Look for calculators that provide accurate real-time data, support multiple currencies, and offer customization options. Additional features such as historical data analysis, portfolio tracking, and interactive charts can enhance the usability of the calculator.

User-Friendly Interfaces and Customization Options

A user-friendly interface is crucial for a seamless user experience. Bitcoin calculators should have intuitive designs, allowing users to input data and view results effortlessly. Customization options such as adjusting timeframes, currency conversions, and investment variables ensure that the calculator meets individual preferences and investment goals.

Security Aspects of Using Bitcoin Calculators and Managing Digital Assets

Security is paramount when dealing with digital assets. It is essential to address the security measures associated with using Bitcoin calculators and managing Bitcoin investments. Discuss topics such as encryption, secure data transmission, two-factor authentication, and cold storage solutions. Emphasize the importance of using reputable calculators and adopting best practices for securing digital assets.

Reviews and Recommendations for Bitcoin Calculators

Bitcoin calculators are essential tools for investors looking to analyze and optimize their Bitcoin investments. Here are some reviews and recommendations for popular Bitcoin calculator tools:

- CoinCola’s Bitcoin Calculator: For traders involved in Bitcoin OTC trading, CoinCola’s Bitcoin Calculator is a valuable tool. It helps users estimate potential profits or losses based on different fiat currencies. Traders find it helpful in managing risk and evaluating trading strategies before executing trades on the CoinCola platform.

- CoinMarketCap’s Bitcoin Calculator: CoinMarketCap is a well-known platform for tracking cryptocurrency prices and market data. Their Bitcoin calculator provides a simple and intuitive interface for calculating the value of Bitcoin in different fiat currencies. Users appreciate its accuracy and real-time data updates, making it a reliable choice for quick calculations. However, it is primarily focused on basic conversions and may lack advanced features for in-depth analysis.

- CryptoCompare’s Bitcoin Mining Calculator: CryptoCompare offers a comprehensive suite of cryptocurrency tools, including a Bitcoin mining calculator. This calculator allows miners to estimate their potential profits by considering factors such as hash rate, electricity costs, and mining difficulty. Users find it helpful for determining mining profitability and optimizing their mining operations. It provides detailed insights into projected earnings and offers a range of customizable parameters for accurate calculations.

- TradingView’s Bitcoin Profit/Loss Calculator: TradingView is a popular platform for technical analysis and charting tools. Their Bitcoin Profit/Loss Calculator enables users to analyze their trading performance by calculating profits or losses based on entry and exit prices. Traders appreciate its simplicity and visual representation of performance metrics. It helps them assess the success of their trading strategies and make informed decisions for future trades.

- CoinTracking’s Portfolio Tracker and Tax Calculator: CoinTracking is a comprehensive cryptocurrency portfolio tracker that also offers a built-in tax calculator. It enables users to track their Bitcoin holdings, analyze profit and loss, and generate tax reports for accurate tax filing. This tool is highly regarded for its extensive features, including automated API imports, advanced reporting options, and tax optimization suggestions. It is particularly beneficial for investors with diverse cryptocurrency portfolios.

When choosing a Bitcoin calculator, it’s essential to consider factors such as accuracy, ease of use, features, and the specific requirements of your investment strategy. It’s recommended to explore multiple calculators and read user reviews to determine which one aligns best with your needs. Remember that while Bitcoin calculators provide valuable insights, they should be used as tools to assist in decision-making rather than the sole determinant of investment choices.

VII. Step-by-Step Guide: How to Use a Bitcoin Calculator on CoinCola

Gathering Required Data for Calculation

Before using the Bitcoin calculator on CoinCola, gather the necessary data for accurate calculations. This includes the amount of Bitcoin you own or plan to invest, the current Bitcoin price, and any relevant transaction fees or expenses associated with buying or selling Bitcoin.

Inputting Data into the Bitcoin Calculator

- Visit the CoinCola website and navigate to the Bitcoin calculator section.

- Enter the amount of Bitcoin you own or plan to invest in the designated field.

- Input the current Bitcoin price, which you can find from reliable sources or CoinCola’s real-time market data.

- If applicable, include any transaction fees or expenses incurred during buying or selling Bitcoin.

- Double-check that all the inputted data is accurate.

Analyzing the Results and Making Informed Decisions

Once you’ve inputted the necessary data, the Bitcoin calculator on CoinCola will provide you with the calculated results. Here’s how to interpret and analyze the information:

- Total Value: The calculator will display the total value of your Bitcoin holdings or investment based on the entered data.

- Profit/Loss: It will indicate the profit or loss you would make based on the current Bitcoin price and any associated transaction fees.

- ROI (Return on Investment): The calculator may also show the return on investment percentage, which indicates the profitability of your Bitcoin investment.

Use these results to make informed decisions regarding your Bitcoin holdings or investment strategy. Consider factors such as your investment goals, risk tolerance, and market conditions.

Staying Updated with the Latest News and Trends in the Bitcoin Market

To stay informed and make better decisions, it’s essential to keep up with the latest news and trends in the Bitcoin market. Here are some tips:

- Follow Reliable News Sources: Stay updated by following reputable news sources that cover Bitcoin and the broader cryptocurrency industry. Websites like CoinDesk, CoinMarketCap, and Cointelegraph provide valuable insights and analysis.

- Join Online Communities: Engage with online communities, such as cryptocurrency forums and social media groups, where you can discuss and share knowledge with like-minded individuals. Reddit’s r/Bitcoin and BitcoinTalk are popular platforms for Bitcoin-related discussions.

- Follow Influencers and Experts: Identify influential figures and experts in the Bitcoin space, such as industry leaders, analysts, and prominent investors. Follow their social media accounts or subscribe to their newsletters for expert opinions and market insights.

- Set up Price Alerts: Utilize cryptocurrency tracking platforms or exchanges that offer price alert features. Set alerts for specific price thresholds to receive notifications when Bitcoin reaches your target levels.

- Attend Webinars and Conferences: Stay updated on the latest developments in the Bitcoin market by attending webinars, virtual conferences, or local meetups. These events often feature industry experts sharing insights and discussing market trends.

By incorporating these tips into your routine, you can stay well-informed about the Bitcoin market, which will help you make more educated decisions when using a Bitcoin calculator or engaging in Bitcoin investments.

Conclusion

In conclusion, utilizing a Bitcoin calculator is a powerful tool for investors seeking to make informed decisions in the dynamic world of digital currency. By understanding Bitcoin’s potential, the role of a Bitcoin calculator, and key metrics for calculations, investors can optimize their investments and manage risks effectively. Choosing the right Bitcoin calculator, following a step-by-step guide, and staying updated with market trends empower investors to navigate the Bitcoin market confidently. By incorporating visual representations, such as graphs and charts, this article ensures that readers can grasp complex concepts easily and stay engaged throughout their investment journey. Emphasize the importance of embracing Bitcoin calculators as a valuable resource for achieving financial goals and highlight the potential that Bitcoin holds for future investors.

FAQs

Bitcoin calculators provide accurate calculations based on the data and variables the user inputs. However, it’s important to note that the accuracy of the results depends on the accuracy of the data and the assumptions made. Factors such as market volatility and unforeseen events can impact the actual returns. It is advisable to use Bitcoin calculators as a guide and consider them alongside other factors when making investment decisions.

Bitcoin calculators cannot predict future prices with certainty. They are tools designed to analyze historical data and provide estimations based on the given variables. The cryptocurrency market is highly volatile and influenced by various factors, making accurate price predictions challenging. Bitcoin calculators help investors understand the potential outcomes based on historical performance, but they should not be solely relied upon for predicting future prices.

Yes, there are several free Bitcoin calculator tools available for investors to use. These tools offer basic functionalities such as calculating returns, factoring in transaction fees, and analyzing investment scenarios. Popular free Bitcoin calculator tools include CoinCola, CoinMarketCap, CoinGecko, and CryptoCompare. While free calculators may have limitations compared to premium versions, they still provide valuable insights for investors starting their Bitcoin investment journey.