How to Convert BTC to Cedis in Ghana

Introduction

The cryptocurrency revolution has arrived in Ghana, with Bitcoin gaining popularity as a means of transferring funds across borders and converting them into the local currency Cedis. Though still in its infancy, the market for exchanging BTC to Cedis promises to grow substantially in the coming years as FinTech services gain mainstream adoption and Ghana’s government provides regulatory clarity.

For proactive investors interested in trading between BTC and Cedis, opportunities to profit and benefit from changing technology abound. However, volatility and risks remain inherent in any emerging market, cryptocurrency and Ghana alike. By understanding the landscape, key players, services available, and current trends, Ghanaian cryptocurrency traders can reap the rewards of an exciting new financial system growing around Bitcoin and Cedis.

This article explores how to convert BTC to Cedis in the current market, what the future may hold for cryptocurrency and money transfers in Ghana, options beyond just trading on exchanges, and strategies to keep safe and stay ahead of coming changes. The era of decentralized money has arrived on Ghanaian shores – let’s dive into how to ride the waves of innovation and profit along the way. The future of BTC and Cedis is bright, if at times turbulent – fasten your seatbelts for the road ahead!

What is Bitcoin?

Bitcoin(BTC) is a digital currency that can be used to buy products and services from vendors who accept Bitcoin as payment. Bitcoin is a decentralized currency, meaning it is not issued by any government. Instead, Bitcoin is created through a process called “mining” in which specialized computers solve complex algorithms. Once Bitcoin has been mined, it can be exchanged for traditional currency on Bitcoin exchanges and used to purchase goods and services.

Why would someone want to convert BTC to Cedis?

There are a few reasons why someone may want to convert their Bitcoin to Cedis. The main reasons are:

- To use the money to purchase goods and services in Ghana. Bitcoin is still not widely accepted as a payment method in Ghana compared to the local currency Cedis. By converting to Cedis, you have more options to spend your money.

- To gain stability. Bitcoin can fluctuate greatly in value over short periods of time. Cedis are a stable fiat currency, so converting to Cedis locks in the value of your funds.

- To send funds to friends or family in Ghana. Cedis can be transferred directly between Ghanaian bank accounts, while Bitcoin transfers require technical knowledge to complete.

How to convert BTC to Cedis

Here are the basic steps to convert your BTC to Cedis:

- Find an exchange that allows you to trade BTC for Cedis.

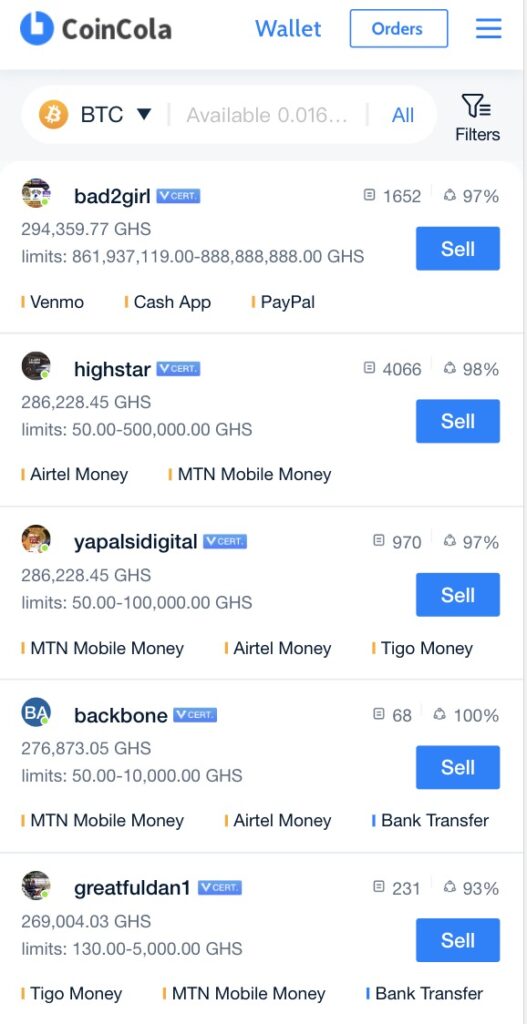

Two reputable exchanges that support BTC/GHS trading pairs are CoinCola, Remitano, and Yellow Card.

- Create an account on the exchange and verify your identity.

You will need to provide documents like copies of your passport or driver’s license to get verified.

- Deposit your Bitcoin to the exchange.

Once your account is verified, you will receive a Bitcoin deposit address to send your BTC. After your deposit has been confirmed on the blockchain, the BTC will be credited to your exchange account.

- Place an order to sell your BTC for Cedis.

On the exchange, you can place a sell order to trade your BTC for Cedis at the current market rate.

- Withdraw your Cedis.

Once the trade has been completed, you can get the Cedis from the vendors to your local Ghanaian bank account. Most withdrawals are processed within 1 to 3 business days.

- Use or withdraw your Cedis as needed.

Your Cedis can now be used locally in Ghana through your bank ATM card, bank transfers, payments, etc.

Risks to be aware of converting BTC to Cedis

While converting Bitcoin to Cedis can be straightforward, there are some risks to keep in mind. Exchanges can get hacked or go bankrupt, so there is a risk that you lose access to your funds. Bitcoin’s value can drop dramatically after you make a trade, resulting in a loss of funds if timed incorrectly. Individual Bitcoin wallets can also get hacked if not properly secured.

For these reasons, only trade with amounts you can afford to lose access to, and enable all security features like 2-factor authentication on exchanges and wallets to reduce risks. By following these best practices, converting Bitcoin to Cedis in Ghana can be done safely and efficiently.

Finding the Best Exchange Rates

To get the most Cedis for your Bitcoin, it is important to compare rates across different exchanges. Some tips for finding the best rates:

- Compare major exchanges like CoinCola, Remitano, and Yellow Card. See which exchange has the highest BTC/GHS rate listed. Rates can vary by up to 2% or more between exchanges.

- Time your trade carefully. Exchange rates fluctuate often based on market activity and other factors. Monitor the BTC/GHS rate on different exchanges around the time you want to trade and place your order when you see the highest rate. Even small price moves can add up to big savings when exchanging a large amount of BTC.

By following these tips, you can convert your Bitcoin to Cedis at the best possible net rate. However, also keep in mind that rate hunting too vigorously may expose you to more risk if an exchange folds or turns out to be fraudulent. It is best to focus the majority of your trading activity on reputable and trustworthy exchanges.

Future of Bitcoin and Cedis in Ghana

The cryptocurrency market in Ghana is still in its infancy, but growing quickly. Some things to look out for in the future include:

- Bitcoin adoption rising. More vendors in Ghana may start accepting Bitcoin as a payment method. This could increase demand for BTC, raising the price and local exchange rates. However, Bitcoin’s volatility would need to subside first before mainstream vendor acceptance.

- Regulatory changes. Ghana’s government may introduce new regulations around cryptocurrencies which could impact the ease and legality of converting BTC to Cedis. Most expect Ghana to regulate crypto favorably to encourage innovation, but policy changes are difficult to predict.

- New exchanges launching. As crypto popularity grows, more exchanges are likely to launch in Ghana, providing more options and competition for traders. This could reduce fees and increase rates over the long run. However, new exchanges also bring more risks around security, scams, and fraud that investors will need to consider.

- Cedi inflation. Ghana’s Cedi has experienced high inflation for long periods of time, which reduces its purchasing power over the years and decades. BTC may become more appealing as a store of value if Cedi’s decline in purchasing power is not curtailed through policy fixes. This could drive exchange rates higher.

- Volatility changes. If Bitcoin becomes less volatile over time, whether naturally or through the emergence of new stablecoins backed by BTC, it may appeal to more mainstream investors and the public in Ghana. Wider appeal and adoption would support higher BTC/GHS exchange rates. However, if BTC remains as volatile as ever, its mainstream reach will stay limited.

Overall, the crypto environment in Ghana promises to remain quite dynamic in years to come. Investors interested in converting between Bitcoin and Cedis should keep a close eye on regulatory and adoption changes to maximize their rates and returns over the long run. Staying up-to-date on trends in both cryptocurrencies as well as Ghana’s economy and policies can lead to more profitable investing decisions when moving funds between BTC and Cedis.

Other Options for Transferring Money With Cryptocurrency

While converting Bitcoin to Cedis is a popular method for sending and receiving funds, other options are emerging that are worth being aware of:

- Stablecoins: As mentioned previously, stablecoins aim to provide price stability by being backed 1:1 with fiat currency or exchange-traded commodities. Popular options like USD Tether (USDT) and Gemini Dollar (GUSD) are always worth $1.00. Stablecoins will eventually give Ghanaians a USD-pegged digital payment method with the quicker settlement than bank transfers or other traditional rails.

- Mobile money: Mobile money services like MTN Ghana Mobile Money and Vodafone Cash could integrate cryptocurrency transfers and payments into their platforms. Ghana’s high mobile money usage would make crypto-to-mobile money a popular service. Cryptocurrency would provide mobile money providers access to lower-cost settlement infrastructure.

- P2P marketplaces: Peer-to-peer services like CoinCola and Remitano that allow direct Bitcoin-to-Cedi trades between people may become more common. As these sites increase in popularity, they can provide fair exchange rates and low fees with minimal fraud risk. P2P is an easy way for crypto newcomers to convert small amounts of Bitcoin to Cedis to test the waters.

- Decentralized exchanges: Non-custodial DEXs like AirSwap are gaining traction globally. DEXs allow traders to convert cryptocurrencies without trusting their money to a third-party exchange. Instead, trades are peer-to-peer and decentralized. DEX adoption in Ghana could provide the benefits of P2P trades but with higher volume and liquidity.

- Globally available fintech services: Platforms such as Wise (formerly TransferWise) and WorldRemit allow inexpensive international money transfers from countries where cryptocurrencies are more regulated and integrated into financial services. As these mainstream fintech companies build crypto capabilities and enter the African market, they would give Ghanaians more seamless options to convert abroad and transfer crypto-based funds home. However, regulation may delay the reach of these services in Ghana.

With increasing smartphone penetration, more digital finance platforms are sure to emerge in Ghana that tap into cryptocurrency to cheaply facilitate money transfers across borders. Keeping an eye on the developments in crypto-based remittances and payments will benefit those looking to convert funds or send money with Bitcoin.

Conclusion

While converting Bitcoin to Cedis holds promise, risks remain. Exchange rates fluctuate widely, and scams abound. However, with increasing crypto adoption, Bitcoin and Cedis may integrate further.

For investors, opportunities await but require caution. Monitor trends, compare rates, and assess service reputations to benefit while reducing risk. New fintech and P2P services will emerge to ease conversions and crypto-based remittances.

Overall, cryptocurrency’s future in Ghana is bright but unpredictable. Regulations, Bitcoin price swings, and platform changes will intertwine. Progress will proceed unevenly.

By staying alert yet patient, the persistent can utilize or profit from Bitcoin and Cedis. But expect a bumpy ride; cryptocurrency is just gaining speed in Ghana. Keep hands on the wheel – the road ahead is long but exciting. Conversions will get easier, but stability remains far off.

Though volatile, the horizon holds the promise of convenient crypto payments and transfers. Ghanaians can participate as financial systems shift, but anticipate pitfalls and wear a ‘seatbelt’. With time and grit, the destination feels within reach. The era of crypto has dawned in Ghana. The rules of money are changing – let the journey begin.