Is ETH Worth Holding?

Ethereum Introduction

Ethereum is the second cryptocurrency after Bitcoin by market capitalization. And it holds this high position for the last several years. Ethereum Mainnet was launched in 2015 and it was a revolution in the cryptocurrency world. The new Ethereum network allowed not only to store and transfer coins, but also to develop decentralized applications using the smart contract mechanism. These new features attracted software developers. Ethereum has the largest and most active developer community today. In terms of the number of dApps in the 2019 year, Ethereum is far ahead of all competitors: half of all decentralized applications work on the Ethereum platform. Ethereum founder Vitalik Buterin is perhaps the most respected and popular person in the blockchain industry.

Current problems of Ethereum network

Ethereum market cap is tens of billions of dollars, and any malfunction of the network can be very expensive. Therefore, the implementation of updates and improvements in Ethereum takes a lot of time and requires a long and thorough review. In recent years, many new blockchains have appeared (EOS, TRON, IOST), which call themselves “Ethereum killers” and try to solve problems that have not yet been solved in the Ethereum network.

The main disadvantages of Ethereum:

- Low transaction speed. Ethereum’s performance is approximately 5-15 TPS (transactions per second), depending on the type of transaction (regular ETH transaction / token transfers/contract calls). It causes to the poor scalability. Ethereum has been developing updates to solve this problem for many years: Plasma (sidechains for scalability) and Sharding to increase TPS. But the deadlines of the implementation updates have been postponed for more than one year.

- Using PoW (Proof-of-work). This consensus algorithm is reliable but very expensive and not eco-friendly. Ethereum plans to introduce a Casper update to switch PoW to PoS(Proof-of-stake) in 2020, but we cannot be sure that it will not be rescheduled.

• Lack of privacy. All transactions and the use of DApps are completely transparent, which does not allow storing private information on the Ethereum blockchain and developing applications operating with such sensitive information. Even Vitalik Buterin acknowledges this problem, and the Ethereum foundation gives grants to startups working to resolve the privacy issue on the blockchain (implementation of the zk-SNARK / zk-STARK zero-knowledge protocols)

If Ethereum implements all these important upgrades slowly, younger and more decisive competitors will be able to take market share away from Ethereum in the coming years.

Ethereum perspectives

There were a lot of Bitcoin forks and other projects that “improved” Bitcoin’s algorithm in one way or another: increased speed, reduced commissions, privacy implementation. But Bitcoin is still unconditional TOP-1 among all blockchains. Yes, it may not be the best by all criteria, but it is popular, and it is reliable because of this popularity. And Bitcoin is popular because it was the first blockchain. So Ethereum was the first blockchain with the smart contracts technology, and competitors will have to try really hard to remove Ethereum from the pedestal.

Here are the factors why Ethereum will retain its high place in the coming years:

- Ethereum is by far the most decentralized among the blockchains with smart contracts. You cannot even compare the Ethereum and the EOS with its 21 block producers or with TRON which nodes are all directly or indirectly controlled by Justin Sun.

- Making decisions about the future of the broadcast is transparent, and people who make important decisions are respected and trusted by the community. Vitalik Buterin is a great crypto visioner, he is here for technology, not for big money, not for pumps and dumps. But even Buterin does not control the Ethereum network, it already has unique governance.

- Ethereum has the most dedicated and large community of developers.

Programming language Solidity is used for development on Ethereum. Solidity was designed specifically for this purpose. Many dApp developers have already mastered Solidity and it is convenient for them to continue using their Solidity knowledge instead of mastering new languages. - If Ethereum can implement the planned important network updates in the next few years, then Ethereum 2.0 will simply deprive the meaning of the rest of the blockchains with smart contracts. After all, Ethereum 2.0 will be just as fast, convenient, and at will anonymous, but it is much more reliable and decentralized.

Place of ETH in the cryptocurrency portfolio

If you are thinking about holding a cryptocurrency portfolio, then Ethereum definitely deserves the right to be present in the main places. Of course, it is unlikely that the price of ETH will increase by 100 times because the capitalization of Ethereum is already quite large. But it is also unlikely that Ethereum could completely depreciate or disappear from the top cryptocurrency market in the coming years. The more conservative your portfolio, the greater the share of it should be occupied by such coins as Bitcoin and ETH.

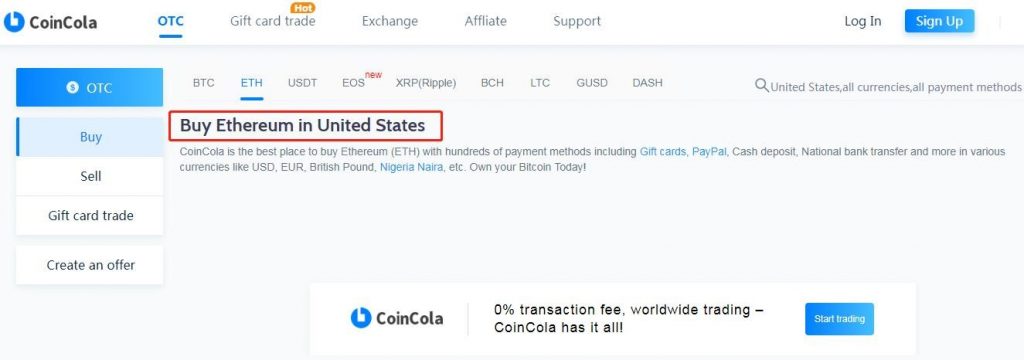

Buy ETH on CoinCola Today!

Or Use CoinCola’s Cryptocurrency Converter Calculator Tool to Check ETH Price in USD.

The ‘ETH Trading Zone’ on CoinCola