Blockchain & Remittances: A Faster & Cheaper Way to Send Money in 2019Blockchain y remesas: una forma más rápida y económica de enviar dinero en 2019

Remittance payments remain to be a regular routine of many workers around the world, especially in the developing countries.

People who work outside of their home are constantly looking for ways to send money back home to support their families.

Yet, remittance offices are taking a sizeable percentage away from the people who need it most.

Blockchain’s Potential on Remittance

Remittance services is one of the most lucrative businesses of banks, specifically for deals done between institutions.

According to Accenture, banks process cross-border deals valued between 25-30 trillion USD each year, with a total number of 100-150 billion deals completed.

Traditional remittance services are usually complicated, time-consuming, and most importantly expensive. That is when blockchain technology comes to play.

Bitcoin was the first application fo Blockchain technology where the distributed-ledger technology can cut costs and increase payment efficiency without a middle-man.

Such frictionless experience for users to send money directly provides a faster and cheaper option, which can be conducted via P2P (peer-to-peer) platforms, such as CoinCola.

What Drives Expensive Remittance Services

Inefficient Correspondent Banking System

Using the banks to transfer money overseas are somewhat “noncompetitive” when it comes to the exchange rates and hidden fees.

Additionally, the amount of time it takes for banks to process your transfer to the other ends are longer than other providers can offer.

Banks also charge high commission and unfavourable exchange rates.

Market Monopoly in Remittance

Other than banks, there are other money transfer providers in the market providing relatively “cheaper and faster” services, and people who work abroad rely on them to transfer money back home.

These providers take 5-10% for transfer fees which might seem a small amount to many people. However, for countries with low cost of living, even 1 dollar can buy many basic goods, such as a pack of sanitary pads, 3 bags of rice, and half a chicken.

Despite the “high” service charge, foreign workers do not have other choices, unfortunately, given the limited alternatives. Thinking from a capitalist standpoint, the offerings of money transfer service providers do not change overtime.

How to Send Money Using Cryptocurrency

Users in LATAM countries relies heavily on remittance service to send money back home. Existing remittance providers, such as Western Union, charge at least 10% to send money.

Furthermore, it takes time to actually process the payment. Plain inconvenient. With CoinCola, we can save both time and cost for you!

Find an All-in-One Cryptocurrency Exchange

CoinCola is a cryptocurrency OTC platform that allows users to trade major cryptocurrencies with low costs. Users are able to convert your money to digital assets such as Bitcoins via our OTC platform directly from your mobile devices or desktops.

We offer a direct peer-to-peer crypto transfer technology on in CoinCola Wallet that does not require an intermediary taking your money away from you.

CoinCola is based on Blockchain technology that is secure, reliable, and fast.

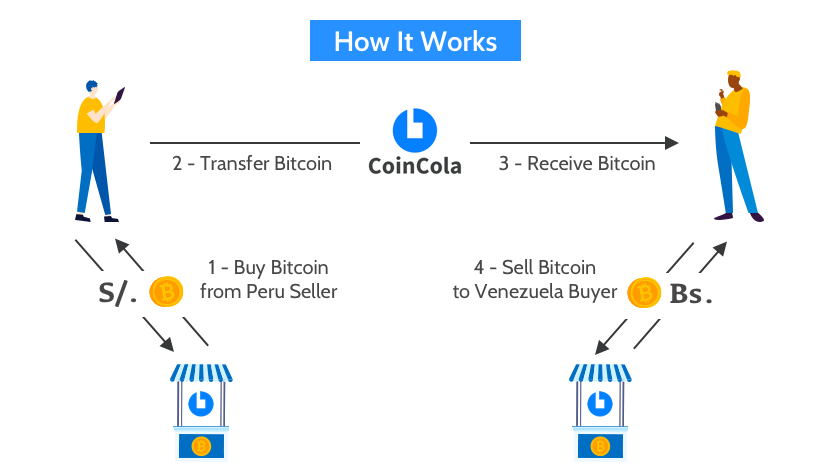

How It Works

- Say your dad working in Peru wants to send you money. He will first find the Bitcoin seller on CoinCola and convert his Sol to Bitcoin via OTC platform.

- Then, he will transfer the BTC to you via CoinCola wallet for free (up to 0.5 BTC).

- You will find a Bitcoin buyer in Venezuela and sell your BTC for bolívares soberanos.

- It’s completely FREE OF CHARGE and can be done in 15 minutes just on CoinCola.

About CoinCola

Founded in 2016, CoinCola is a Hong Kong based company offering both over-the-counter cryptocurrency trading and crypto-to-crypto pair trading exchange. CoinCola now serves millions of users from over 150 countries with our fast, secure, and reliable trading services. We support BTC, ETH, BCH, LTC, USDT, DASH, and XRP. Visit www.coincola.com for more information.

Calculating your current Bitcoin holdings? Check out our real-time Crypto Converter here.

Muchos trabajadores realizan de forma regular los pagos de remesas en todo el mundo, especialmente en los países en desarrollo.

Las personas que trabajan fuera de su hogar están buscando constantemente maneras de enviar dinero a casa para apoyar a sus familias.

No obstante, las oficinas de remesas están tomando un porcentaje importante de las personas que más lo necesitan.

Potencial del Blockchain en cuanto a las remesas

Para los bancos los servicios de remesas son uno de los negocios más lucrativos, en especial para las transacciones realizadas entre las instituciones.

De acuerdo con Accenture, los bancos procesan acuerdos transfronterizos valorados entre 25 y 30 billones de dólares anuales, con un total de 100 a 150 mil millones de operaciones completadas.

Los tradicionales servicios de remesas son generalmente complicados, requieren mucho tiempo y, lo que es más relevante, costosos. Ahí es cuando la tecnología blockchain entra en juego.

Bitcoin fue la primera aplicación de tecnología Blockchain donde la tecnología-ledger pudo reducir costos y aumentar la eficiencia de pago sin necesidad de un intermediario.

Esta experiencia cuyo propósito es que los usuarios realicen directamente envíos de dinero proporciona una opción más rápida y económica, que se puede llevar a cabo mediante plataformas P2P (peer-to-peer), como por ejemplo CoinCola.

Lo que impulsa los costosos servicios de remesas

Ineficiente sistema de banca corresponsal

el uso de los bancos a fin de transferir dinero al extranjero es algo que resulta “nada competitivo” cuando se trata de los tipos de cambio y las tarifas ocultas.

Asimismo, la cantidad de tiempo que le toma a los bancos en procesar su transferencia a otros destinos es mayor a lo que otros proveedores pueden ofrecer.

Adicionalmente los bancos también cobran altas comisiones así como los tipos de cambio nada favorables.

Monopolio de mercado en cuanto al envío de remesas

además de los bancos, existen otros proveedores que realizan transferencias de dinero en el mercado con el fin de proporcionar servicios relativamente “más económicos y más rápidos”, mientras que las personas que trabajan en el extranjero confían en ellos para transferir dinero a sus hogares.

Plataforma OTC de Criptomonedas: CoinCola

Los usuarios de los países latinoamericanos dependen en gran escala del servicio de remesas para enviar dinero a casa. Los actuales proveedores de remesas, tales como Western Union, cobran al menos el 10% para enviar dinero. De igual forma, el mismo requiere tiempo para procesar un pago. Lo que es claramente un inconveniente. Con CoinCola, podemos ahorrarle tiempo y costos.

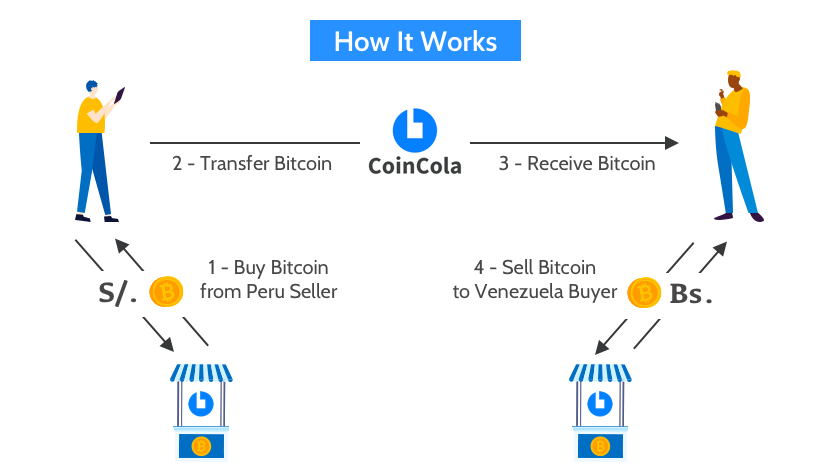

How It Works

- Say your dad working in Peru wants to send you money. He will first find the Bitcoin seller on CoinCola and convert his Sol to Bitcoin via OTC platform.

- Then, he will transfer the BTC to you via CoinCola wallet for free (up to 0.5 BTC).

- You will find a Bitcoin buyer in Venezuela and sell your BTC for bolívares soberanos.

- It’s completely FREE OF CHARGE and can be done in 15 minutes.

About CoinCola

Founded in 2016, CoinCola is a Hong Kong based company offering both over-the-counter cryptocurrency trading and crypto-to-crypto pair trading exchange. CoinCola now serves millions of users from over 150 countries with our fast, secure, and reliable trading services. We support BTC, ETH, BCH, LTC, USDT, DASH, and XRP. Visit www.coincola.com for more information.

Calculating your current Bitcoin holdings? Check out our real-time Crypto Converter here.

![[:en]blockchain cryptocurrency remittance coincola[:]](https://www.coincola.com/blog/wp-content/uploads/2019/02/blockchain-cryptocurrency-remittance-coincola.png)