How to Profit from Bitcoin Price Fluctuations in 2023

Bitcoin is one of the most popular and valuable cryptocurrencies on the market. As with any asset, its value is subject to change and volatility. While this can be daunting for some investors, it also presents an opportunity for those who know how to profit from these fluctuations. In this article, we’ll explore how to make money from Bitcoin price fluctuations in 2023.

Understanding Bitcoin Price Fluctuations

To make money from Bitcoin price fluctuations, you need to understand how they work. Bitcoin prices are driven by supply and demand. The more people that want to buy Bitcoin, the higher its price will be. Conversely, the more people that want to sell Bitcoin, the lower its price will be. Other factors that can impact Bitcoin prices include government regulations, media coverage, and the overall state of the global economy.

Strategies for Profiting from Bitcoin Price Fluctuations

1. Buy and Hold

One of the simplest strategies for profiting from Bitcoin price fluctuations is to buy and hold. This involves purchasing Bitcoin and holding onto it for an extended period, with the expectation that its value will increase. This strategy can be risky, as Bitcoin prices can be highly volatile, but it can also be very rewarding if you have a long-term investment horizon.

2. Trading

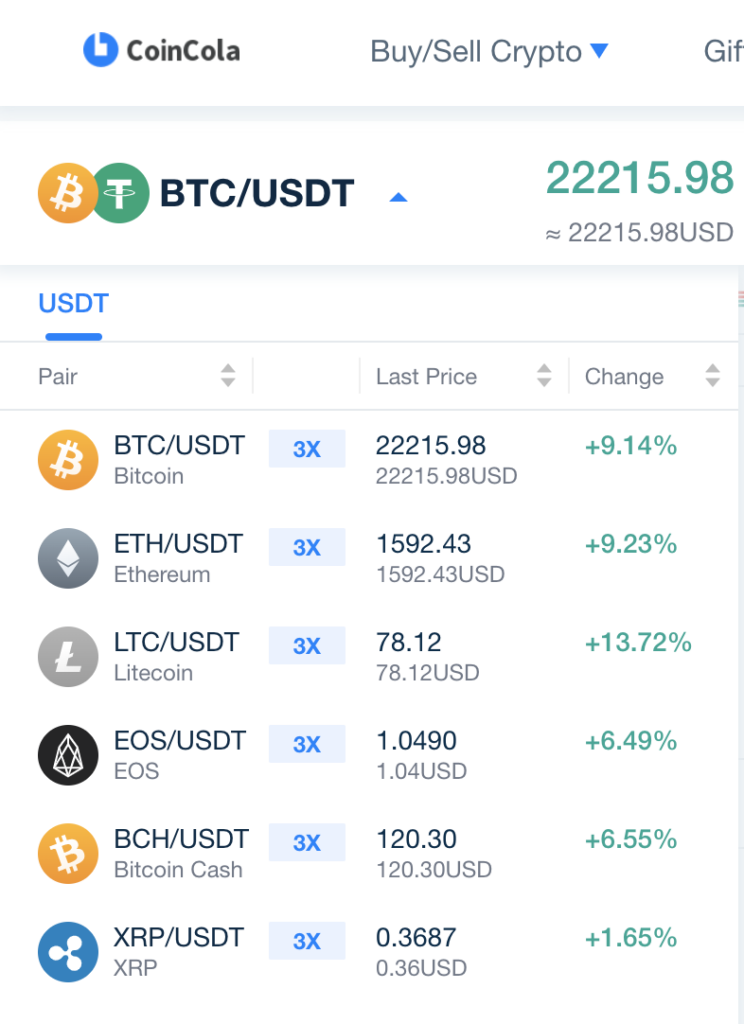

Another way to profit from Bitcoin price fluctuations is to trade Bitcoin. This involves buying Bitcoin when its price is low and selling it when its price is high. Trading requires a significant amount of knowledge and skill, as well as a willingness to take risks.

3. Mining

Bitcoin mining is the process of verifying transactions on the Bitcoin blockchain and adding them to the public ledger. Miners are rewarded with new Bitcoins for their work. While mining can be profitable, it requires a significant amount of technical knowledge and expensive hardware.

4. Arbitrage

Arbitrage is the practice of buying Bitcoin on one exchange and selling it on another exchange for a higher price. This strategy requires a significant amount of research and knowledge of different exchanges and their prices.

5. Margin Trading

Margin trading allows you to trade Bitcoin with borrowed funds. This strategy can be very profitable if you know what you’re doing, but it can also be very risky if you don’t. Margin trading should only be attempted by experienced traders.

Tips for Profitable Bitcoin Trading from Bitcoin Price Fluctuations

Before investing in Bitcoin, it’s important to do your research. Learn as much as you can about Bitcoin and the factors that can impact its price.

1. Do Your Research

Before investing in Bitcoin, it’s important to do your research. Learn as much as you can about Bitcoin and the factors that can impact its price.

2. Use Dollar-Cost Averaging

Dollar-cost averaging involves buying a set amount of Bitcoin at regular intervals, regardless of its price. This strategy can help you avoid buying in at the top of the market.

3. Set Stop-Loss Orders

Stop-loss orders can help you limit your losses in case the market turns against you. Set a stop-loss order to automatically sell your Bitcoin if its price falls below a certain point.

4. Don’t Invest More Than You Can Afford to Lose

Bitcoin prices can be highly volatile, so it’s important to never invest more than you can afford to lose.

5. Keep Your Emotions in Check

Emotions can cloud your judgment when it comes to investing. Try to keep your emotions in check and make rational decisions based on data and analysis.

Conclusion

Bitcoin price fluctuations can be both a challenge and an opportunity for investors. By understanding how Bitcoin prices work and implementing the right strategies, you can profit from these fluctuations in 2023. Whether you choose to buy and hold, trade, mine, arbitrage, or margin trade, it’s important to do your research, set realistic goals, and manage your risk appropriately.

Remember, investing in Bitcoin is not a get-rich-quick scheme. It requires patience, discipline, and a long-term investment horizon. If you’re willing to put in the time and effort, however, there’s no reason why you can’t profit from Bitcoin price fluctuations in 2023 and beyond.

FAQs

A1. Investing in Bitcoin involves risk, and it is important to conduct thorough research and understand the risks involved before investing.

A2. The best way to profit from Bitcoin price fluctuations depends on your investment goals, risk tolerance, and experience. Buying and holding Bitcoin, trading it, and mining it are all viable options.

A3. The amount of money needed to invest in Bitcoin to make a profit depends on many factors, such as the current price of Bitcoin, your investment goals, and your risk tolerance. It is important to conduct thorough research and consult with a financial advisor before making any investment decisions.

A4. The decision to buy or sell Bitcoin should be based on thorough research and analysis of the market. It is important to stay up-to-date with the latest news and developments in the industry and to consult with a financial advisor if needed.

A5. Bitcoin mining profitability depends on many factors, such as the cost of electricity, the price of Bitcoin, and the mining difficulty. It is important to conduct thorough research and analysis before investing in Bitcoin mining.

![[:en]How to Profit from Bitcoin Price Fluctuations in 2023[:]](https://www.coincola.com/blog/wp-content/uploads/2023/03/How-to-Profit-from-Bitcoin-in-2023.png)