4 Easiest Ways to Send Money to Nigeria from the US

Is your current way to send money to Nigeria a rip-off? Now, I know a lotta you out there are hustling hard in the US of A, and sometimes a little piece of that hustle needs to get back home to Naija. Maybe mama needs some support, or you wanna bless your younger cousin with the latest kicks. Whatever the reason, sending money across the big pond can feel like navigating a game of Lagos traffic – hectic and confusing.

Fear not, my people! I’m here to break it down for you nice and easy. Today, we’re gonna explore the 4 easiest ways to send money from the US to Nigeria. We’ll be talking transfer fees, speed, and all that good stuff. So grab your cup of ogbono soup, settle in, and let’s get this naira flowing!

1. The Old Reliable: Money Transfer Services

This one’s a classic for a reason. Big names like Western Union and MoneyGram have been in the game for decades, offering a reliable way to send cash straight to your loved one’s hands. It’s as simple as walking into a store, showing some ID, and filling out a form. Your recipient can then pick up the money at a designated location in Nigeria.

Pros:

- Fast and convenient: Money can be picked up within minutes, depending on the service.

- Widespread reach: These services have locations all over Nigeria, making it easy for your recipient to access the funds.

- No bank account needed: Perfect if your recipient doesn’t have a bank account yet.

Cons:

- Fees can bite: Transfer fees can be pretty high, especially for smaller amounts.

- Exchange rates might not be the best: You might not get the most competitive exchange rate for your naira.

You may like: What Are The Best Ways to Send Money to Nigeria in 2025? (Full Guide)

2. Bank Transfers: The Safe and Steady Option

This method might take a little longer than money transfer services, but it can be a good option if you’re sending a larger amount. You can initiate the transfer directly from your US bank account, either online or by visiting a branch.

Pros:

- Potentially lower fees: Compared to money transfer services, bank transfers can sometimes offer better rates, especially for larger transfers.

- Secure and reliable: Banks have robust security measures in place to protect your money.

Cons:

- Slower transfer times: It can take a few business days for the money to reach your recipient’s account in Nigeria.

- Not as accessible: Your recipient will need a Nigerian bank account to receive the funds.

3. Mobile Money: The Tech-Savvy Choice

If you and your recipient are both comfortable with mobile technology, then mobile money transfer services like WorldRemit or Afriex could be a great option. These services allow you to send money directly from your phone to your recipient’s mobile wallet. They’re often faster and cheaper than traditional money transfer services.

Pros:

- Fast and convenient: Send and receive money with just a few taps on your phone.

- Competitive fees: Mobile money services often offer lower fees than traditional money transfer services.

- Wide availability: Many mobile money services operate in Nigeria.

Cons:

- Limited cash access: Depending on the service and your recipient’s location, they might not be able to withdraw the money as cash.

- Data charges apply: Make sure you have a data plan to use the mobile money app.

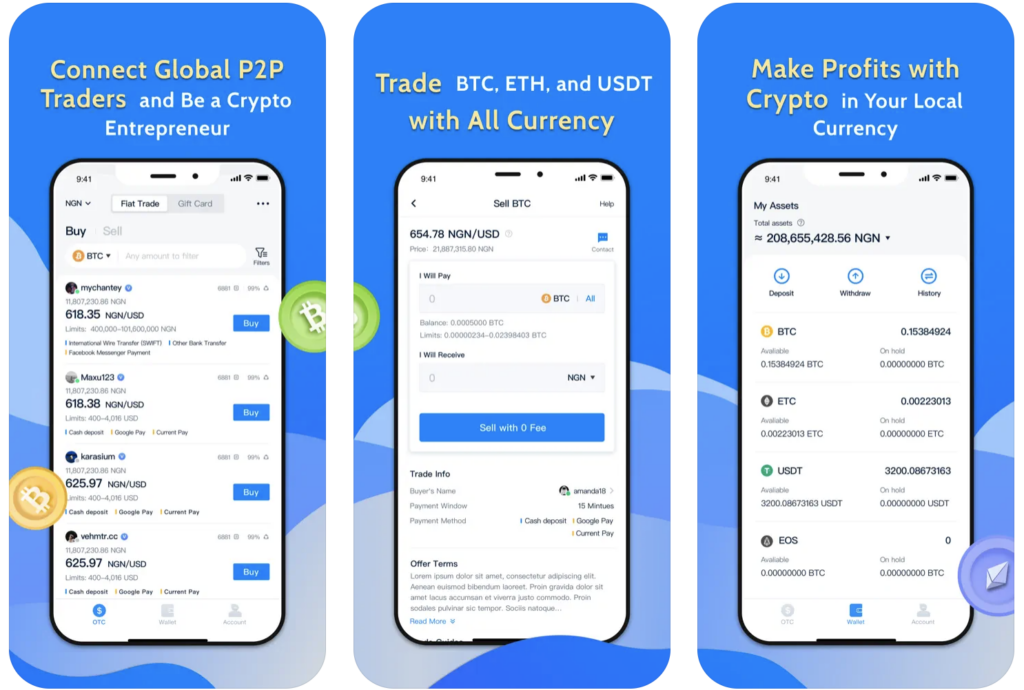

4. P2P Crypto Trading: Dive into the Digital Age

Now, this one’s for the adventurous cats out there! Peer-to-peer (P2P) crypto trading platforms like CoinCola allow you to use cryptocurrency to send money to Nigeria. Here’s the gist: you buy cryptocurrency with your US dollars, and your recipient in Nigeria sells it for naira on the platform. They get their money, and you avoid some of the traditional fees.

Pros:

- Potentially lower fees: Compared to traditional money transfer services, P2P crypto trading can offer competitive rates.

- Fast transfer times: Once the cryptocurrency is sold, your recipient can access the naira almost instantly.

- Secure transactions: Many P2P platforms use escrow services to ensure secure transactions.

Cons:

- Requires some crypto knowledge: You’ll need to understand the basics of buying and selling cryptocurrency.

- Volatility risk: The value of cryptocurrency can fluctuate, so there’s a slight risk of losing money on the exchange.

- Regulation: Cryptocurrency regulations are still evolving in many countries, including Nigeria. This means there might be some uncertainty about the tax implications of using crypto for money transfers.

P2P Trading on CoinCola: A Step-by-Step Guide

Alright, intrigued by that P2P crypto trading option? Let’s break it down using CoinCola as an example. Here’s a step-by-step guide to get you started:

Step 1: Sign Up and Verify Your Account

Head over to CoinCola’s website or App and create an account. You’ll need to provide some basic information and complete the verification process to ensure secure transactions.

Step 2: Find a USDT Seller in Nigeria

USDT (Tether) is a popular stablecoin pegged to the US dollar, making it a good choice for money transfers. Browse CoinCola’s listings and find a seller in Nigeria offering USDT at a competitive rate.

Step 3: Initiate the Trade

Once you’ve found a seller, place an order for the desired amount of USDT. CoinCola will hold your USDT coins in escrow until your recipient completes the trade.

Step 4: Your Recipient Sells USDT for Naira

Your recipient in Nigeria will need to create a CoinCola account as well. They’ll then agree to your trade and provide their bank details.

Step 5: CoinCola Releases Funds

Once your recipient confirms they’ve received the USDT, CoinCola will release your US dollars to the seller’s account. The naira equivalent will be deposited into your recipient’s bank account.

Conclusion

There you have it, Oga Ameriyan! Four easy ways to send money back home to Naija. Remember, the best option for you will depend on factors like transfer speed, fees, and your recipient’s access to technology and banking services. Don’t hesitate to shop around and compare rates before making a decision.

Bonus Tip:

Always prioritize security! Whether you’re using a money transfer service, bank transfer, or P2P crypto platform, make sure you’re using a reputable company with strong security measures in place.

Now go forth and get that naira flowing! Remember, sharing is caring, so feel free to share this article with your fellow hustlers abroad. And if you have any questions, don’t hesitate to drop a comment below. Until next time, stay blessed!

You may like: How to Transfer Money from Ghana to Nigeria in 2024

FAQs

Look, Naija’s gotta get its naira, but safety first! Sending with a legit company with a good rep is like having mama watch your back at the market – no shady characters. Just avoid those random emails promising millions (too good to be true, my friend).

Depends on the method. Money transfer services are the Usain Bolts of the bunch, getting your money there sometimes the same day! Bank transfers are more like a relaxing stroll through Tinubu Square – a few business days. Mobile money and P2P crypto are the tech superstars, whizzing your money over in minutes, shakara free!

Ugh, fees can be a real headache. Money transfer services usually charge the most, like that aunty who pinches every kobo at the owambe. Mobile money and P2P crypto can be a bit lighter on your pocket, but shop around to find the best deal.

Many services are cool with debit cards, letting you send money with a tap, tap. Just check with your bank first – they might have some extra charges waiting to sneak up on you.