What Happened to QuadrigaCX $190 Million Exit Scam & How to Avoid ItCómo esta empresa de criptomonedas perdió $ 190 millones de fondos de los clientes

QuadrigaCX was Canada’s biggest cryptocurrency exchange. It was started by Gerald Cotten all the way back in 2013; long before crypto became mainstream. And now over $190 million of investors’ funds are missing.

Like many other crypto exchanges, QuadrigaCX was wary of getting hacked by criminals. To protect its platform and users’ funds, it used a cold wallet to store crypto assets. Nothing strange there; cold storage is standard procedure for most (if not all) exchanges.

What is strange is the following. Gerald Cotten was the only person who could access QuadrigaCX’s cold wallet. Nobody else at the company had the power and responsibility to handle company (and user) funds.

Read also: 2 Questions to Ask While Choosing a Secure Crypto Exchange

This became a problem as Cotten died on December 9 2018 while traveling in India. Since nobody else can access the wallet, all of QuadrigaCX’s assets are now officially gone.

According to Cotten’s widow, Jennifer Robertson, the wallet contents include over 24,488 Bitcoin, 11,378 Bitcoin Cash, and 429,966 Ethereum coins. All told, the value of all the crypto assets held in the wallet was well over $190 million.

How it happened

If you’re like most of us, you might find it hard to believe that $190 million were lost so easily. You wouldn’t be alone. Many of QuadrigaCX’s users reacted with shock, disbelief, and horror when they discovered they may have lost their money forever.

However, the truth is that what happened isn’t that strange. Cold wallets – physical forms of storage disconnected from the Internet – cannot be restored if lost.

For example, let’s say your cold wallet is a passcode written down on a piece of paper. If someone sees and remembers your code, they’ll be able to access your wallet and your funds. Once they do, you won’t be able to do much (if anything).

Digital cold wallets aren’t necessarily safer. For example, a USB drive can be burned, damaged, lost, or corrupted by magnetic fields. Should this happen, any stored funds will have been lost instantly.

For all these reasons, large companies that rely on cold storage have processes to restore lost access. Unfortunately, QuadrigaCX didn’t have any processes like these – and as a result, they lost all of their users’ money.

The silver lining here is that we can all learn a lesson from QuadrigaCX. Cold wallets aren’t necessarily superior because they’re disconnected from the Internet. If you’re like most people, you may be better off using a multisig online wallet – like the one in CoinCola.

Multisig Bitcoin Wallet

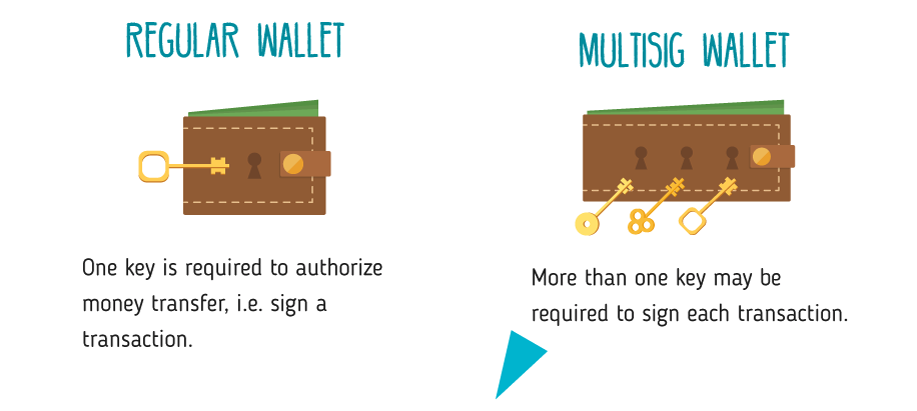

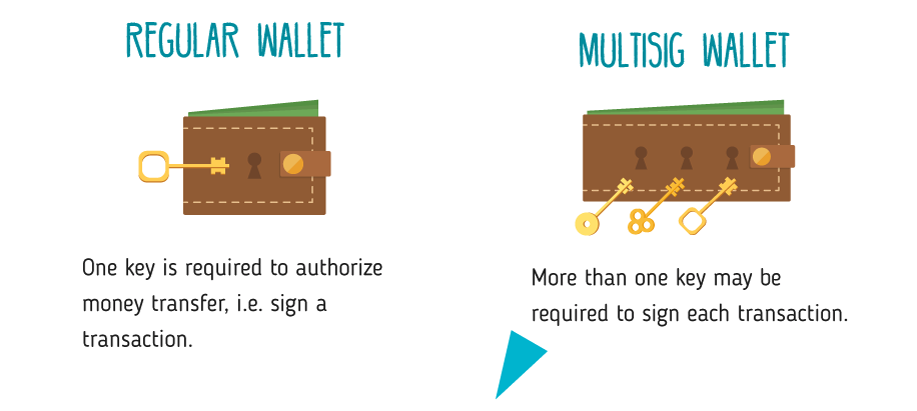

A multi-signature wallet is a wallet that you need more than one key to open. A wallet like this can’t be opened with just one key; a user needs several keys, all of them correct, to gain access.

Wallets like these are vastly more secure than regular crypto wallets. They can also be recoverable (unlike QuadrigaCX’s cold wallet). For example, CoinCola’s multisig wallets are linked to user accounts – so after a verification process, users can recover lost access easily.

Which option is right for you?

Cold storage is useful. However, it can also result in the complete and total loss of all your funds. Since we’re a company, we have a number of safeguards to prevent this from happening – but as a user, you may not have access to the same.

To this end, it may be better to use a good multisig wallet instead of a cold one. That’s what many of CoinCola’s users do, to the tune of over 100,000 on-platform transactions per month.

To find out more about CoinCola or open a multisig wallet with the crypto trading service, visit our website: CoinCola.com.

En Canadá, la empresa QuadrigaCX fue el más grande exchange de criptomonedas. Fue iniciado por Gerald Cotten desde el año 2013; mucho antes de que el cripto se convirtiera en tendencia.

Del mismo modo que muchos otros cripto exchanges, QuadrigaCX se mantenían cauteloso ante un ataque o hack por parte de criminales. Con el fin de proteger su plataforma así como los fondos de los usuarios, utilizó una billetera fría para almacenar activos de criptomonedas. Nada extraño por ahora; El almacenamiento en frío o (Cold storage) es un procedimiento estándar para la mayoría (o todos) los exchanges.

Lo extraño es lo siguiente. Gerald Cotten fue la única persona que pudo tener acceso a la billetera fría de QuadrigaCX. Nadie más en la compañía disponía de tal poder y la responsabilidad de manejar los fondos de la empresa (así como la de los usuarios).

Esto se convirtió en un problema cuando Cotten falleció el 9 de diciembre de 2018 mientras se encontraba viajando por la India. Debido a que nadie más tiene la posibilidad de acceder a la billetera, todos los activos de QuadrigaCX ahora han desaparecido.

De acuerdo con la viuda de Cotten, Jennifer Robertson, el contenido de la cartera encierra más de 24,488 Bitcoin, 11,378 Bitcoin Cash y 429,966 monedas de Ethereum. En total, el valor de todos los cripto activos guardados en la billetera fue de más de $ 190 millones.

¿Cómo pudo suceder algo como esto?

Si eres como la mayoría de nosotros, puede que te resulte difícil creer que $ 190 millones se perdieron tan fácilmente. No estarías solo. Muchos de los usuarios de QuadrigaCX quedaron en shock, otros incrédulos y horrorizados cuando descubrieron que podían haber perdido su dinero para siempre.

No obstante, lo que sucedió no es algo tan extraño a decir verdad. Las billeteras frías (formas físicas de almacenamiento desconectadas de Internet) no se pueden restaurar en caso que se pierdan.

Por ejemplo, digamos que su billetera fría es un código de acceso escrito en una hoja de papel. Si alguien ve y recuerda su código, será capaz acceder a su billetera y a sus fondos. Una vez que lo hagan, no lograrás hacer mucho al respecto (si acaso algo).

No son del todo seguras estas las carteras frías digitales . Por ejemplo, una unidad USB puede ser quemada, dañada, perdida o deteriorada por campos magnéticos. Si esto sucediera, todos los fondos almacenados se habrán perdido instantáneamente.

Por estos motivos, las grandes empresas que dependen del almacenamiento en frío cuentan con procesos a fin de restaurar el acceso perdido. Por desgracia, QuadrigaCX no tenía a su disposición ninguno de estos procesos y, como consecuencia, todo el dinero de sus usuarios lo perdieron.

El lado positivo es que por parte de QuadrigaCX podemos aprender una valiosa lección. Las billeteras frías no son del todo superiores porque están desconectadas de Internet. Si usted es como la mayoría de las personas, es mejor que utilice una billetera en línea multisig, como las que ofrece CoinCola.com.

Carteras multi-firma

Al hablar de una billetera de firma múltiple se refiere a una billetera que requiere más de una llave para abrirse. Una billetera de este tipo no se puede abrir con tan solo una llave; un usuario requiere varias llaves, todas ellas correctas, con el fin de obtener acceso.

Estas carteras son mucho más seguras que las carteras de criptomonedas comunes. Además pueden ser recuperables (a diferencia de la billetera fría de QuadrigaCX). Por ejemplo, las carteras multisig de CoinCola están vinculadas a las cuentas de usuario, por lo que después de un proceso de verificación, los usuarios pueden recuperar el acceso perdido fácilmente.

¿Cuál opción es la indicada para ti?

El almacenamiento en frío o (Cold Storage) es útil. Sin embargo, este sistema puede resultar en una pérdida total de todos sus fondos. Como somos una empresa, disponemos de una serie de medidas de seguridad con el fin de evitar que algo por estilo suceda, pero como usuario, es posible que no tenga acceso a la misma.

Con ese propósito, puede ser la mejor opción utilizar una buena billetera multisig en vez de una billetera fría. Eso es lo que muchos de los usuarios de CoinCola hacen, con la suma de más de 100,000 transacciones en la plataforma por mes.

Para obtener más información sobre CoinCola o para abrir una billetera multisig, visite nuestro sitio web ahora: CoinCola.com.

![[:en]QuadrigaCX Exit Scam[:]](https://www.coincola.com/blog/wp-content/uploads/2019/03/What-is-happening-with-quadrigaCX.jpg)